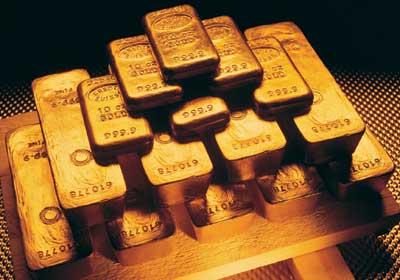

GOLD - $650 An Ounce By End of 2006, Say Analysts

How high will the price of GOLD rise before YOU consider buying some?

Gold Will Shoot Up To $650 An Ounce By End of 2006, Say Analysts

Sunday, 18 December, 2005 (08:26am)

LONDON (Reuters) - Heavy demand for gold from Russia, China, India, the Middle East and possibly the US is likely to push the price up to a record high of $650 an ounce by the end of 2006, a fund manager said.

In the US, where demand for gold is about half that of Europe, concern about the impact of the changeover at the millennium boosted gold demand in 1999, and fear could at some time be a factor again, Frank Holmes, chief executive of US Global Investors, said this week.

“If fear takes hold the price of gold could jump faster than people are expecting,” he told Reuters.

Historically the highest price for spot gold was seen in 1980 at $850 an ounce and recently Japanese demand has pushed prices up over $540 an ounce, a rise of nearly 24% so far this year.

Most of the demand has come from fund managers looking to diversify their portfolios into precious metals which have little or no correlation to stocks and bonds and central banks swapping dollar reserves for gold. Emerging market consumers are also buying more gold jewellery.

“Emerging markets are driving up the price of gold,” Holmes said.

Holmes’s fund invests in gold miners. It has around $1bn under management and in the 12 months to September it returned nearly 20%.

“The supply coming out of gold mines has been falling for the past couple of years and will continue to fall to the end of the decade. The birthing process to bring new supply on stream can take 10 to 15 years.”

The prospect of some central banks raising the proportion of gold they hold in their reserves is also on the agenda and adding to the atmosphere of gold fever in the market.

Last month, Russian President Vladimir Putin called on the central bank to gradually raise gold reserves. Russia currently holds around 386 tonnes or 12.4mn troy ounces of gold.

“That triggered a rise above $500 an ounce,” Holmes said.

“Prior to that there was China, which we know is aiming to turn 2.4% of its foreign currency reserves into gold.”

UK-based consultancy GFMS expects total world demand for gold to rise 7% this year to 3,383 tonnes.

It sees the fastest pace of demand growth in India - 26% to 881 tonnes in 2005 from 702 tonnes in 2004.

“Economic growth and incomes are rising in India,” Holmes said. “The Middle East is also recycling some of its trillions of petrodollars into gold.”

GFMS expects a 6% rise in gold demand to 679 tonnes compared with 641 tonnes in 2004 in the Middle East.

But Holmes thinks that a trigger for another lurch higher, towards $650 an ounce could be a sharp rise in demand from consumers in the US.

“Americans become gold buyers out of fear. In 1999 everyone was worried that at the turn of the millennium everything would fall out of the sky. Americans bought 2mn ounces of gold eagle (coins) that year,” he said.

US demand for gold is likely to rise just 1% this year to 251 tonnes and European demand to fall 6% to 533 tonnes, according to GFMS.

“If European central banks hadn’t been selling gold it would have been at $650 already,” Holmes said, adding that if they accelerate their gold sales then price rises could be limited.

© 2005 Reuters News Service

Source:

The following sources were used in the creation of this Kentroversy Paper . . .

Gold Will Shoot Up To $650 An Ounce By End of 2006, Say Analysts (December 18, 2005)

0 Comments:

Post a Comment

<< Home